What is EUAR / UKCA?

EEA in Europe (including EU and EFTA)

and sell in Britain

The sold goods are certified by CE and UKCA

The manufacturers of goods

outside EU or Britain

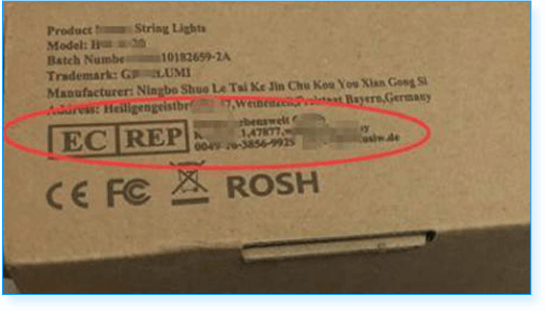

Toy Packaging

Electronical Packaging

Note: Common items including toys, games, televisions, stereos, protective equipment by self, machinery, the goods of construction, gas equipment, leisure or private boats, pressure vessels, and measuring equipment etc.

What can eVAT Master do for you?

Sign a one-year EUAR or UKCA agreement and

provide this service

The EUAR or UKCA information can be printed

on the product packaging or parcel and can also

be attached on the relevant document

Confirm the follow-up service such as providing

a DOC template etc.

Note: Our services do not include logistics, sales, goods return, clearance by the Customs, infringement, trademarks or patent etc.

Furthermore, we do not provide the service of signing the DOC (also known as Declaration of Conformity)

Service Advantage of eVAT Master

Reasonable Price

The price structure is clear and visualized

Simple Process

Store data online

Press one button and declare tax

Monitor weight thresholds in real-time

Be professional

and authoritative

Our experts are from domestic and international and provide a series of related specialized services

Be efficient and smart

Farewell the traditional

and inefficient declared method

Accept a newer smart way

of online registering and declaring

The Service Process of EEA / UKCA and Timing

Register

an eVAT Master

account in 30 seconds

Purchase

an EUAR / UKCA service online

It is convenient and efficient

Submit

your information in 5 minutes

Sign

an authorized EUAR / UKCA agreement

Authorize successfully in the 1-3 working days

The Consequences of not registering EUAR / UKCA

How to apply into EUAR / UKCA?

1. Update the EUAR or UKCA information on Amazon account information

2. The EEA or UKCA information is printed on the product packaging,

product manual and product tag.